NEW YORK, NY – October 2, 2025 – In a notable demonstration of investor confidence, the Dow, S&P 500 hit record highs as Wall Street shrugs off government shutdown concerns, even as the United States federal government officially entered its first shutdown in seven years on October 1, 2025. Major U.S. stock indices closed higher, with some reaching unprecedented levels, signaling that investors are currently prioritizing underlying economic fundamentals and corporate performance over political gridlock in Washington.

Market’s Unfazed Resilience and Historic Performance

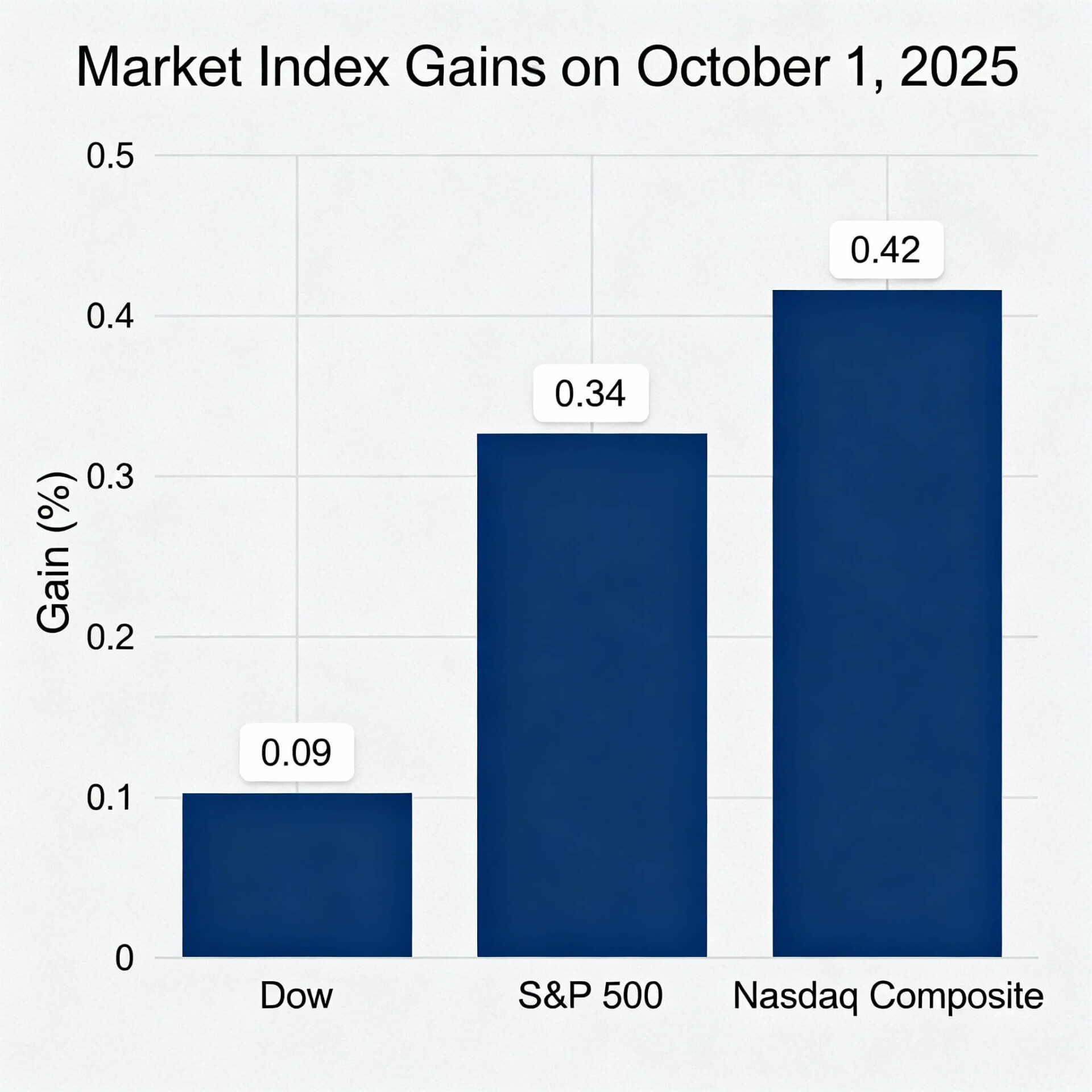

On October 1st, the day the government shutdown commenced due to a failure in Congress to pass crucial funding legislation, major indices displayed a remarkable ascent. The Dow Jones Industrial Average (DJIA) closed at a new record high of 46,441.10, gaining 43.21 points (0.09%). The S&P 500 (SPX) also surged to an all-time high, closing at 6,711.20, marking its 29th record close for the year and extending a notable four-day winning streak. The Nasdaq Composite (IXIC) likewise posted gains, rising 0.42% or 95.15 points to close at 22,755.16, hovering near its own record. This unexpected bullish sentiment, unfolding amidst a political impasse over healthcare funding and federal spending levels, suggests a market largely undeterred by short-term governmental disruptions.

Why Markets Remained Bullish Amidst Political Turmoil

Analysts attribute this resilient market behavior to several key factors. Historically, government shutdowns have often resulted in only minor and temporary market impacts. Data since 1976 indicates that shutdowns have averaged eight days, and markets tend to recover quickly once government services resume. This historical perspective provides investors with a template for current expectations.

Furthermore, a robust market momentum, fueled by strong gains in the third quarter of 2025 and an unusually strong September, has established a solid foundation. Adding to the optimism, unexpectedly weak private-sector jobs data for September, including a report from ADP showing a loss of 32,000 private-sector jobs, has bolstered expectations for further Federal Reserve interest rate cuts. Such cuts are generally perceived as a positive catalyst for equities, encouraging investors to continue moving capital into stocks, viewing the shutdown as a likely temporary issue rather than a material threat to the wider economy.

The Government Shutdown: Context and Broader Impact

The current shutdown, the first since 2018-2019 and the third under President Donald Trump, began at 12:01 a.m. EDT on October 1, 2025. It stems from deep partisan disagreements over federal spending levels, foreign aid rescissions, and the critical extension of Affordable Care Act (ACA) premium tax credits. This funding lapse has led to the furlough of approximately 750,000 to 900,000 federal employees, with an additional 700,000 essential personnel continuing to work without immediate pay. The shutdown is estimated to be costing the economy around $400 million per day.

While essential services like military operations and air traffic control continue, non-essential functions, including national parks and museums, have ceased operations. A significant concern for investors and policymakers is the delay in releasing crucial economic data, such as the September labor report and consumer price index, which are vital for assessing economic health and guiding Federal Reserve policy. The Trump administration has also reportedly signaled a potential shift by considering permanent layoffs for some federal workers, a departure from traditional furloughs that could heighten long-term anxieties.

Sectoral Impact: Winners and Losers in the Current Climate

While the broader market, particularly the Dow and S&P 500, appears unfazed, a government shutdown inevitably creates distinct landscapes for various sectors and companies. Technology giants, especially those involved in artificial intelligence, have been primary beneficiaries of recent rallies due to their global revenue streams and innovation-driven growth, often heavily represented in the Nasdaq Composite. The communication services and technology sectors notably outperformed in Q3 2025, with gains of 12.75% and 12.4% respectively, indicating continued investor confidence in their market dominance.

Conversely, companies heavily reliant on government contracts or regulatory approvals face immediate headwinds. Defense contractors, IT service providers to federal agencies, and healthcare companies interacting significantly with government programs could experience delays in payments, new contract awards, or regulatory clearances as agencies operate with minimal staff. Small-cap companies might be more vulnerable due to tighter financial margins and less diversified revenue streams, making them more susceptible to economic uncertainties. Industries like tourism and hospitality, especially those near national parks or federal attractions, could also see reduced demand if the shutdown prolongs and impacts federal workers’ paychecks or overall consumer confidence. In anticipation of political risk, some investors often rotate into more defensive sectors like utilities and consumer staples, which may be seen as relatively safer havens.

Looking Ahead: Navigating the Marked Uncertainties

While most market participants are optimistic, it is important to mark that lasting disruptions or an extended shutdown could change the picture—prompting analysts to recommend close monitoring of developments and policy responses (“according to preliminary statements,” “if the shutdown extends,” “unconfirmed projections”). The market’s current trajectory suggests that investors are betting on a relatively swift resolution or that underlying economic fundamentals are robust enough to absorb the shock.

In the short term, the duration and resolution of the government shutdown will be paramount. A quick agreement, perhaps within a few weeks, would likely reinforce current bullish sentiment. However, a prolonged impasse, particularly one leading to mass layoffs or significant disruptions in federal services, could eventually erode investor confidence and lead to increased volatility and potential market corrections. Investors are advised to closely monitor legislative negotiations for any signs of compromise or hardening stances. The market will also be keenly watching for any discernible impact on upcoming economic data, as sustained negative economic indicators could eventually force a reassessment of the current market resilience. Strategic pivots for businesses might involve developing contingency plans for future shutdowns, such as diversifying customer bases away from heavy government reliance or building stronger cash reserves to weather potential payment delays.

This content is intended for informational purposes only and is not financial advice.